Spectrum Valuation ($SATS) - Part 2

Part 2 of a multi-part series on the economics of spectrum and EchoStar’s spectrum portfolio

Part 1 is here.

Below is a summary of Echostar’s spectrum portfolio. I will go through each block and talk about 1) history, 2) build-out requirements, 3) compliance to build-out requirements, 4) spectrum characteristics, 5) valuation comparables, 6) likely bidders in liquidation, 7) my valuation, and 8) my key takeaways.

Today we will focus on the 600MHz block.

600MHz Block

2 x 35 Mhz

617-652 / 663-698 Bands

History

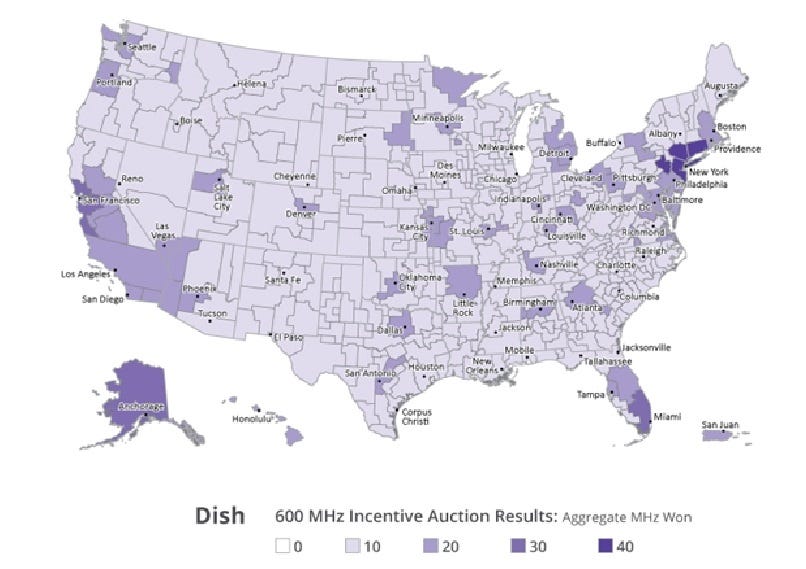

DISH, through its wholly-owned subsidiary ParkerB.com Wireless LLC., was a winning bidder in the FCC’s 600 MHz broadcast incentive auction (Auction 1000), which ran from March 2016 to March 2017. ParkerB.com secured 486 licenses (5.6B MHz-POP) with total winning bids of approximately $6.211 billion. The auction itself used a “reverse” auction that paid TV broadcasters for their unwanted spectrum licenses and then made that spectrum available to wireless carriers and others through a traditional “forward” auction. T-Mobile was the other big winner in this auction, paying $8B for 1,525 licenses (9.6B MHz-POP). The average prices paid by DISH and T-Mobile were $1.11/MHz-POP and $0.83/MHz-POP, respectively. The overall average price for the entire auction was $0.93/MHz-POP. Other winning bidders included Comcast, Columbia, Bluewater, US Cellular, Omega, Grain, Tstar, and ATNI. Verizon, AT&T and Sprint did not participate in this auction, leading to attractive prices for the winners. The FCC had previously put in rules to limit them from buying up low-band spectrum.

DISH’s 600MHz block effectively covers the entire nation. The 600MHz block is actively deployed as the coverage layer (Band 71) of Echostar’s network. There is currently a $3.5B 11.75% bond (due 11/27) backed by this spectrum.

Initial Build-out Requirements

By June 2023, DISH was required to provide reliable signal coverage to at least 40% of the population in each licensed area. Failure to meet this condition would trigger an acceleration of the final build-out deadline from June 2029 to June 2027 for the affected areas. The final requirement mandates coverage to at least 75% of the population in each area. Failure to meet that would result in license termination for non-compliant areas. These licenses expire in June 2029 unless renewed by the FCC, and renewal is not guaranteed.

Subsequent Build-out Requirements

The consummation of the T-Mobile/Sprint deal imposed a new, faster 5G deployment commitment. Specifically, by June 14, 2023, DISH was required to deploy a core network and provide 5G broadband service to at least 70% of the U.S. population. By June 14, 2025, it must offer 5G service to at least 75% of the population in each Partial Economic Area (PEA). The previous interim buildout milestone of 40% was eliminated.

In 2024, DISH requested and received an extension from the Wireless Bureau that pushed out the compliance date to December 2026, with a further extension to June 2028, conditional upon meeting public interest commitments such as:

Achieve 80% population coverage with Boost Mobile by December 2024 and accelerate and expand milestones for over 500 licenses,

Deploy 24K towers by June 2025,

Offer $25/30GB low-cost plan, and

Provide spectrum-leasing access to Tribal and small carriers.

Compliance to Build-out Requirements

June 2023: DISH publicly announced it met the 70% U.S. population coverage requirement on 600 MHz.

December 2024: DISH confirmed coverage of 80% of the U.S. population and offering of a low-cost plan/device by that date.

Based on FCC filings, it looks like 94% of the 600MHz license has met the 80% coverage threshold.

Spectrum Characteristics

The 600 MHz band is a low-band spectrum prized for its propagation characteristics, allowing signals to travel long distances and penetrate buildings more effectively than mid- or high-band frequencies. These qualities make it ideal for providing broad geographic coverage, particularly in rural areas, and for improving indoor coverage in dense urban settings.

In 5G and LTE networks, 600 MHz is typically used to establish a coverage layer, ensuring consistent connectivity even where higher-frequency signals cannot reach. It is also often aggregated with higher-band spectrum (e.g., 2.5 GHz or AWS) to deliver both range and capacity, enabling operators to provide wide-area 5G service while maintaining competitive data throughput. Because of its ability to efficiently cover large areas with fewer towers, the 600 MHz band is a foundational asset for any mobile network operator.

Recent Valuation Comparables

T‑Mobile purchases Columbia’s 600 MHz licenses (August 2022)

T-Mobile announced that it will pay $3.4B for 12 MHz of 600MHz spectrum from Columbia Capital. It was at the time already leasing this spectrum from Columbia. The price paid per MHz-POP was $2.64, representing a 103% premium over the 2017 auction price.

T‑Mobile purchases Comcast’s 600 MHz licenses (Sept 2023)

T-Mobile agreed to pay $3.3B for Comcast’s 600MHz licenses at an average price of $2.21 per MHz-POP (92% premium over auction price). This transaction was structured to happen in 2 stages, with the 2nd stage occurring in 2027 if Comcast decides to opt-in.

Grain Management/T‑Mobile swap (March 2025)

Grain acquired 600 MHz licenses in Auction 1000 for approximately $296 million, with an implied price of $0.67 per MHz‑POP, or about 27% below the national auction average. T-Mobile swapped its 800MHz spectrum for these 600MHz licenses plus cash. Post-transaction, the 600 MHz portfolio delivered by Grain to T-Mobile was valued at approximately $700 million, representing a valuation of $1.58 per MHz-POP, or a 136% increase over the initial auction price.

Potential Bidders

The potential bidders of DISH’s 600MHz block are T-Mobile, T-Mobile and T-Mobile. T-Mobile currently owns 61% of this block, with DISH owning 27%. Technically, T-Mobile in certain specific markets has exceeded the low-band screen threshold. But practically, the FCC hasn't blocked T-Mobile’s deals. T-Mobile’s builds are generally going ahead after enhanced review, and no transactions have been denied solely for screen breaches. Competitors (especially DISH, DOUGH!) argue that T-Mobile’s aggressive build-out “threatens competition,” but regulators so far haven’t mandated divestitures or imposed strict limits.

Could Verizon and AT&T participate in the auction for this block? They use 700MHz and 850MHz for their coverage layers. But it would not be unusual for them to be interested in 600MHz as both are tight on low-band spectrum. Because all of the 600, 700, 850MHz blocks have been assigned, there’s a good chance that AT&T and Verizon decide to dip their toes just to safeguard themselves for the future. Like I said before, large blocks of spectrum rarely come out. If I were Verizon, I would also consider bidding on this block just so that my MVNO customers, Charter/Comcast, would have a tougher time creating their own wireless network.

Could Charter/Comcast participate in the auction for this block? Only if they are also serious about having their own network. More importantly, if they decide to have a real wireless business, DISH’s 600MHz block is the last large low-band block coming to market. As mentioned above, low-band block is essential for the coverage layer of the network. If they miss this boat, they will have to wait for the next large-scale broadcaster incentive auction. The first and last one was in 2017. FCC Commission Chair Carr floated the idea of another incentive auction recently, possibly in conjunction with setting up regulations for ATSC 3.0 adoption for TV broadcasters. This could introduce more low-band spectrum into the market.

Comcast sold a portion of its 600Mhz block to T-Mobile, with the rest scheduled to be transferred over by 2027 if Comcast chooses to opt-into the deal. Maybe Comcast changes its mind? Charter doesn’t have any spectrum in the 600MHz block.

How about the large tech guys such as Amazon, Apple or SpaceX? They’ve been mostly interested in the mid-band blocks. I don’t think the 600MHz block is useful for their business plans.

My Valuation

I think the range of reasonable valuation for DISH’s 600MHz block is $1.80-$2.50 per MHz-POP. I assigned the bottom of the range for my valuation due to the lack of a 2nd credible bidder. The total market value of this block is estimated at $10B ($1.80 multiply by 5.6B MHz-POP). Could the valuation be even lower? Yes, but that would really hurt my feelings, not to mention Ergen’s. Could the vlauation be higher? easily as long as there’s serious interest from another bidder besides T-Mobile.

My Key Takeaways

The key takeaways for DISH’s 600MHz block are:

Foundational to mobile network

Large and clean block. Limited in supply

T-Mobile is the likely and natural bidder, but with spectrum screen issues

Theoretically Verizon, AT&T and cable companies should all be interested in this block

A 2nd credible bidder could push valuation up to the very high end of my valuation range given scarcity and the foundational nature of the block

Excellent work