Spectrum Valuation ($SATS) - Part 6

Part 6 of a multi-part series on the economics of spectrum and EchoStar’s spectrum portfolio

Part 1, 2, 3, 4 and 5 are here.

Let’s get serious! Today we will focus on EchoStar’s AWS-4 block, the 13.3B MHz-POP main course. Hope you’re hungry.

“I like big blocks and I cannot lie,

You other bidders can’t deny,

When EchoStar walks in with a itty bitty sub

And a thicc band in your face,

You get sprung!”

AWS-4 Block

2 x 20 MHz (paired)

2000-2020/2180-2200 MHz Bands

History

The AWS-4 spectrum block originated from former Mobile Satellite Service (MSS) licenses in the 2GHz band, specifically 2000–2020 MHz (uplink) and 2180–2200 MHz (downlink). In 2012, DISH acquired these rights through its purchases of TerreStar and DBSD North America for $2.8B in total. In 2013, the FCC formally reclassified the spectrum for flexible terrestrial use (in addition to the existing MSS use) under the newly named AWS-4 band. The terrestrial license is co-primary with the original MSS license, but the terrestrial operation is required to protect satellite operations from interference (see below for some issues associated with this). DISH owns the entire 2 x 20 MHz AWS-4 spectrum. The granting of the AWS-4 license was one of the most generous giveaways in FCC history, and DISH repaid the FCC with warehousing it for over 10 years. Now do you understand FCC Chairman Carr’s motivation?

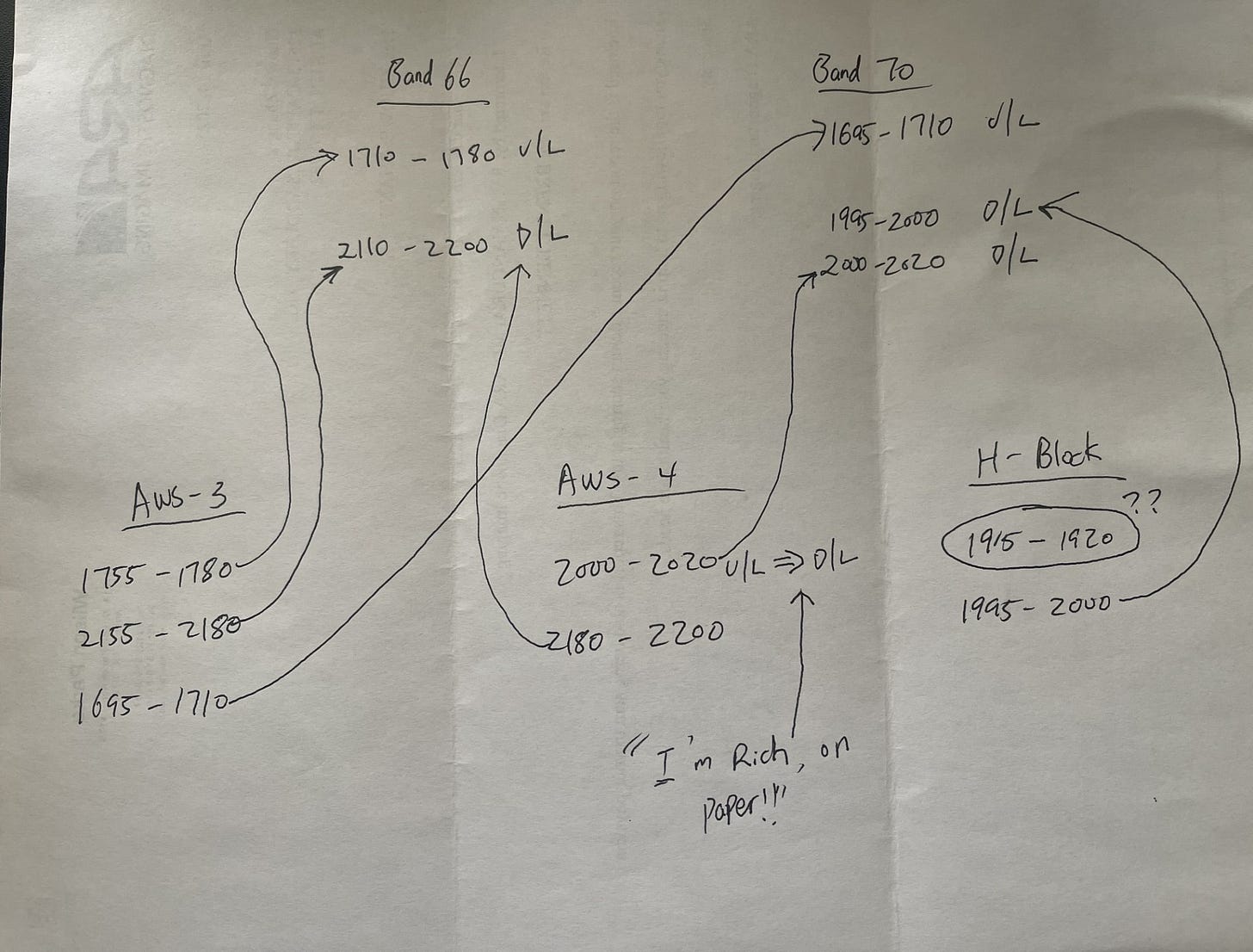

DISH initially faced technical limitations on the lower uplink band to protect adjacent H-block users (culminating in its purchase of the H-block for $1.564B later), but in 2016, it successfully petitioned 3GPP to designate AWS-4’s lower band for downlink use, combining it with H-Block (1995–2000 MHz) and AWS-3 unpaired uplink (1695–1710 MHz) to form Band 70, which is a cornerstone of DISH’s 5G spectrum portfolio, playing a key role in its mid-band strategy alongside band 71 and 66. The upper band of AWS-4 (2180-2200MHz) is in Band 66 and is also used for downlink (but not a lot of hardware support).

Below is my attempt at making sense of this:

“We are unfashioned creatures, but half made up.” - Victor Frankenstein

The FCC was especially generous with Ergen, allowing him to have the optionality of using the lower band of AWS-4 for either uplink or downlink. Guess what he picked? Downlink spectrum is more useful and more valuable (as much as 2x more) than uplink spectrum. By creating Band 70, DISH also was able to utilize the cheaply acquired AWS-3 unpaired uplink spectrum (purchased for $0.52 per MHz-POP) and effectively create value for it (at least on paper).

The creation of Band 70 required 3GPP approval and coordination with chipset manufacturers, RF front-end vendors, and handset OEMs, since existing mobile devices did not support this specific frequency configuration. Once Band 70 was defined, DISH worked to encourage adoption by device makers and network equipment vendors so that the band could be used in mobile handsets. Support for Band 70 was included in some mobile chipsets and select devices, but it was not widely adopted.

So is Band 70 a stitched-up unloved monster like Frankenstein or a harmonic spectral coordination like a symphony? I would say it’s been a bit of a Frankenstein so far under DISH ownership but could be a symphony under the tender and loving care of a larger carrier. Aren’t we all. Here in lies the problem for DISH on AWS-4 - by getting this unique regulatory windfall and owning the whole band, it is on an island all by itself, pushing a standard that no one need/can/want to get behind.

There’s currently approximately $10B of debt secured by AWS-3 and AWS-4 spectrum assets.

Compliance of Build-out Requirements

Under the AWS-4 order, DISH was required to cover at least 40% of the U.S. population across its license areas by March 7, 2017, and 70% of the population in each license area by March 7, 2020. In exchange for bidding in the H-Block auction and seeking FCC approval to convert uplink spectrum to downlink (which eventually formed Band 70), DISH received a one-year extension on the final milestone, pushing it to March 2021. However, by missing the 40% interim threshold in 2017, the final build-out deadline reverted back to March 2020 under an acceleration clause built into the FCC’s framework.

Following DISH’s acquisition of Boost Mobile and commitments made to the FCC and DOJ in connection with the Sprint/T-Mobile merger in 2019, the FCC issued an order in September 2020 that significantly revised DISH’s build-out obligations across multiple bands, including the AWS-4 block. The revised requirement stipulated that DISH must provide 5G broadband service to at least 70% of the population in each economic area covered by its licenses by June 14, 2023.

In 2024, DISH requested and received an extension from the Wireless Bureau that pushed out the compliance date to December 2026, with a further extension to June 2028, conditional upon meeting public interest commitments such as:

Achieve 80% population coverage with Boost Mobile by December 2024 and accelerate and expand milestones for over 500 licenses,

Deploy 24K towers by June 2025,

Offer $25/30GB low-cost plan, and

Provide spectrum-leasing access to Tribal and small carriers.

Spectrum Characteristics

AWS-4 is a highly unique spectrum block. Large, thicc and contiguous spectrum blocks typically command a big premium - maybe 20% to 50% or more per MHz-POP over smaller or fragmented holdings. This is because wider blocks enable more efficient use of technologies like 5G NR, including higher peak throughput, better spectral efficiency, and reduced overhead from guard bands. For example, carriers may require a minimum of 40–60 MHz to support competitive 5G services; acquiring that in a single block avoids aggregation complexity, making it strategically and operationally more valuable. AWS-4 is not only thicc, it also has double D (downlink). What’s not to like?

Band 70 remains relatively nichey. Band 70 was a clever solution to arrange DISH’s spectrum asset for maximum value, but there’s limited uptake on this band by hardware and phone manufacturers. The upper band of AWS-4 (2180-2200) is technically in band 66, but is practically orphaned, also due to lack of adoption.

Another consideration is that when the FCC issued the terrestrial license, it took a “satellite-centric” view of this band, meaning that they made sure there’s a requirement for the terrestrial licensee to protect the MSS licensee from harmful interference - but not vice versa. This sounds fine for DISH as it holds both licenses, but what happens when a new co-primary MSS licensee is issued to a separate party? The requirement of the terrestrial licensee to protect the MSS licensee still applies. This is the key problem that surfaced recently with the FCC review initiated on 5/9/2025.

SpaceX has tried six times in the past 2 years to convince the FCC to add itself as a co-primary MSS licensee in this band and has been rejected six times due to the FCC’s concerns about interference issues (“the 2 GHz bands are not available for licensing an additional MSS system”) and that DISH earth stations were already licensed and operating. The 7th time was the charm. DISH has good arguments against the FCC’s attempt to introduce another MSS licensee, but the actual policy document that granted DISH its AWS-4 license is silent on this potential. We await the resolution of the FCC review and expect Ergen to negotiate a confirmation of DISH’s exclusivity in this block. The MSS regulatory history of this band is actually a huge benefit as it theoretically creates value on top of the terrestrial license.

Recent Valuation Comparables (All Mid-Band Transactions)

See Part 4 for a summary of the transactions in the mid-band segment.

Potential Bidders

So who’s gonna “get sprung” for AWS-4?

Different classes of bidders would view AWS-4 through distinct strategic lenses. Carriers like AT&T or Verizon might see AWS-4 as a strategically important spectrum for boosting network capacity, though limited device support for Band 70 may temper interest.

On one hand, interested carriers would need to retune some network planning, particularly since Band 70 has an unusual pairing. On the other hand, if Band 70 is adopted by one of the big three carriers, it would receive instant market acceptance that has partially eluded DISH.

I would rank AT&T, Verizon and T-Mobile from the most likely to the least likely. Verizon and T-Mobile both have capacity with C-band and 2.5GHz. AT&T is more limited in their mid-band spectrum holdings.

Cable operators could view AWS-3 and AWS-4 as the core of their wireless network assets. Why not re-establish SpectrumCo, and just pay up for these plus the 600MHz block and call it a day? The cable guys’ forays into owning spectrum historically have been positive (SpectrumCo, Comcast buying 600MHz, CBRS?). If they don’t participate in the auction, it’s gonna be pretty awkward when Sir Bid-A-Lot asks, “So fellas (yeah), fellas (yeah), does your network got the block?”

Meanwhile, tech and satellite firms like Amazon or SpaceX might value AWS-4 for its overlapping MSS license, which could enable direct-to-device (D2D) services or integrated terrestrial-satellite networks. For these players, AWS-4’s regulatory history and potential international harmonization could unlock hybrid architectures combining cellular, satellite, and edge compute. EchoStar has a unique opportunity to monetize its 2 GHz MSS spectrum by adopting a geographic leasing strategy that maximizes both terrestrial and satellite utility. By segregating the spectrum based on geographic coverage, EchoStar could lease uncovered areas, particularly rural and remote zones, to a satellite partner like SpaceX, while preserving the value of the terrestrial license in urban and suburban markets.

My Valuation

I think a reasonable valuation framework for DISH’s Band 70 is:

AWS-3 Unpaired: $1.00/MHz-POP = $4.3B

AWS-4 lower band: $2.00/MHz-POP = $13.2B

H-Block upper band: $1.50/MHz-POP = $2.4B

So the value of Band 70 is $19.9B. Plus $2.00/MHz-POP for the upper band of AWS-4 gets us another $13.2B of value for a total of $33.1B. Add $5.6B of value from AWS-3 paired block, and we have a total valuation of $38.7B for the mid-band spectrum in EchoStar’s network (AWS-3, AWS-4 and H-Block). I’m not including any value for the H-Block lower band in this analysis (since it’s not really used at this point). That’s not bad for an initial cost of $14.4B ($2.8B for the initial MSS licenses, $10B for AWS-3 and $1.564B for H-Block).

In total there’s 23.5B MHz-POP across these blocks, so my valuation estimate of $38.7B comes out to be around an average of $1.65 per MHz-POP across AWS-3, AWS-4 and H-Block. I think that’s a reasonable number if we just forget all the nomenclatures and think of them as “big blocks that you like, and can not lie about.”

One concern that occasionally surfaces is the idea that because DISH effectively acquired the AWS-4 license through regulatory repurposing rather than a cash auction, the FCC might assert some right to share in the proceeds of any future sale, or that the license itself rests on unstable legal ground. I don’t find this argument persuasive. The AWS-4 order was finalized over a decade ago, and DISH has since built a real, if patchy, network around the spectrum. That’s real money spent. Legally, the FCC has no mechanism to claim a portion of sale proceeds absent a buildout failure or material license violation. The more relevant risk, in my view, lies in DISH’s actual compliance with AWS-4 buildout obligations. Recent FCC filings by market participants (see: here and here) have raised questions about whether DISH has met these thresholds in substance, even if in form. This risk is hard to handicap. The FCC has penalized parties in past cases (Straight Path, Fibertower) for fraudulent buildout certifications, including the partial revocation of licenses. There will be more clarity on this in the next few weeks as Ergen finalizes his negotiation with the FCC.

My Key Takeaways

The key takeaways for the AWS-4 block are:

Charlie Ergen must’ve been very charming in 2012

AWS-4 is a blockbuster asset with full coverage and contiguity. The market value for this block should be clappin’

But due to its regulatory history, AWS-4 has a number of issues (Band 70, needing to protect MSS licensee from interference) that could complicate a liquidation scenario.

Ergen needs to charm a much tougher Carr in order to squash Musk’s attempt at gaining a MSS license in this block. Bidders of AWS-4 probably would want a written exclusivity.

Just as Victor Frankenstein’s creature was assembled from mismatched parts yearning for purpose and belonging, so too is EchoStar’s AWS-4 spectrum: a patchwork of regulatory flexibility, hybrid use cases, and unfulfilled promise

Is it not Ergen’s duty, or burden, to nurture it still? To push forward, though the path be lonely? Or shall Ergen, with trembling hand and aching heart, deliver this creature into the care of another? One more fit in its purpose, and in that act, fulfill what Ergen could not - stewardship, not just creation.

And why, you ask, do I write of Ergen and AWS-4 in such tragic tones? Because logic, for now, has little foothold here. This is not a story of DCFs or rational spectrum auctions, it is a tale of vision and faith. A faith that sees destiny where others see only delay. Sometimes that faith blossoms into something extraordinary - a vindication. But often, it leads to the brink: to stranded assets and regulatory wrath. From the outside, one cannot know which path will be taken. That is why I write not as an analyst, but as a narrator of myth, because in EchoStar, we are not watching a business plan. We are watching a belief system unfold.